The State of the Market: October 2023

Posted:

Sale Prices & The State of the Market: October 2023

While the net new supply of housing through the pre-construction side of the market is constrained as a result of a number of factors discussed last week (if you missed it you can get back up to speed by checking out last week’s update here), inventory of available for sale housing on the resale market continues to swell as a result of increasing interest rates and fewer active buyers.

Here’s how sale prices and the fundamentals across the local resale market shaped up through the month of September.

Current Supply across the Market

As measured by # of Active Listings

536 condo listings vs. 318 during the same time last year, up 34% since last month

Over the last few months, we’ve seen the supply of active listings increase steadily while demand has tempered amidst increased interest rates. Last month saw the single largest increase in new condo listings with 444 new listings brought to market in the month of September. To put this in perspective, this is almost 2x the number of listings brought to the market during same month last year, up 85% from 240 new listings in September 2022.

Sale Prices vs. Asking Prices

As measured by Sale Price to Original Price Ratio

Condos, on average, selling for 100% of ask but that’s not always the full story

Surprisingly, despite increased inventory on the market and reduced demand as a result of higher interest rates, condos are continuing to sell for close to 100% of their asking price. But this doesn’t always tell the full story.

Why? Despite this occurring statistically, we’re observing an increased number of listings get re-listed that were originally offered at a higher price. These properties are being temporarily taken off the market and re-introduced at a lower price, increasing the chance that it will sell for 100% of its new asking price but skewing the stats to suggest a tighter offer market than what is actually the case.

But are prices actually falling? The short answer is they have since the beginning of 2022 but average and median prices have actually increased since values were at their lows at the end of last year and beginning of 2023. Average sale prices of condos in Waterloo Region were $562,339 last month down slightly from August but up slightly from July and prior months this year.

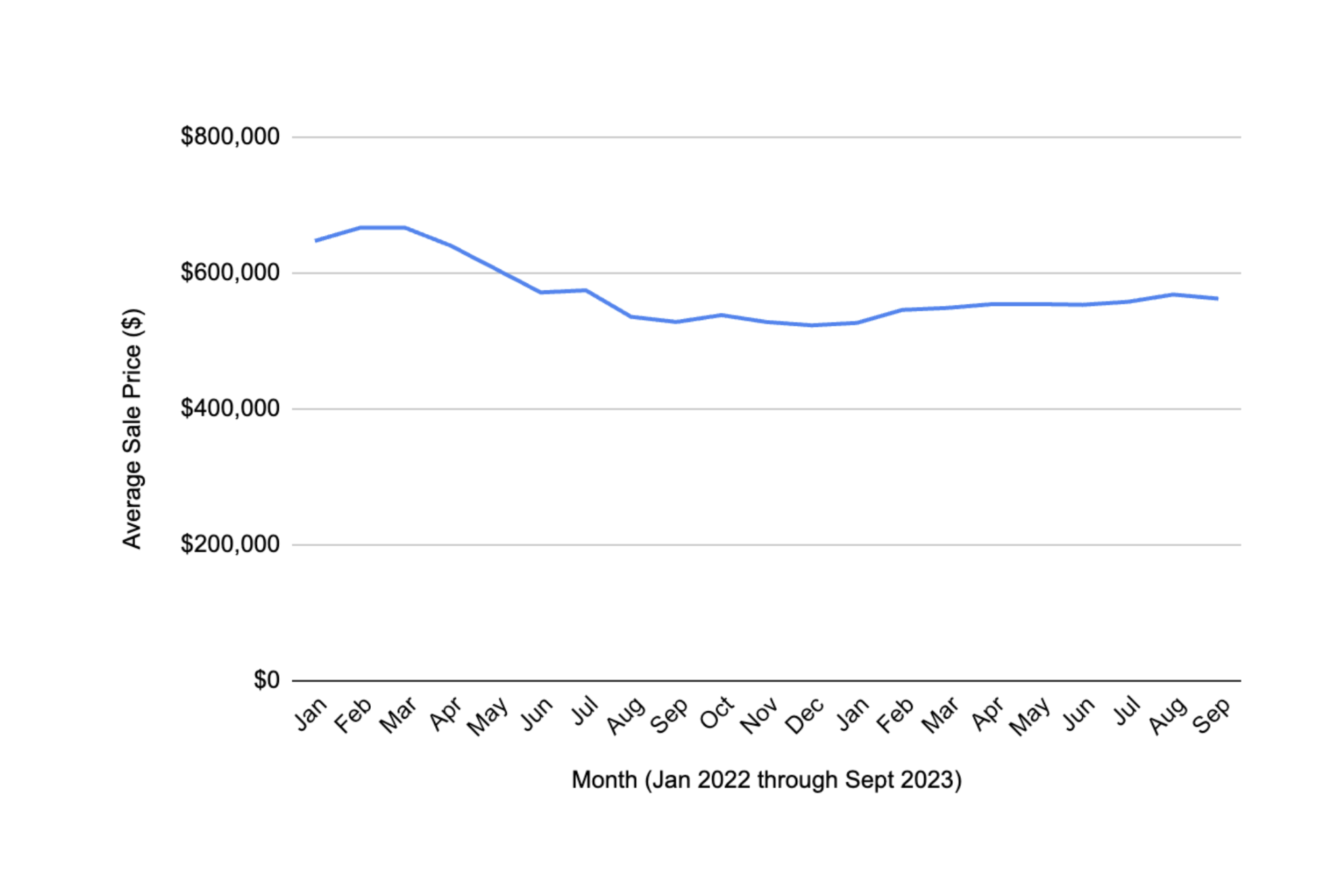

To give you a fuller picture of where values are now relative to where they were, here’s how average sale values across the local market have trended since January 2022.

Average & Median Sales Prices since Beginning of 2022

The median and average condo sale prices as of the end of September were $545,000 and $562,339, respectively up from $483,500 and $526,572 at the beginning of the year but down significantly from their peak in February 2022 at $650,000 and $666,758.

While sales prices continue to fluctuate, they are now significantly less than where they were at the peak of the market and we’re continuing to see select opportunities come available that are starting to offer tremendous value. For those of you looking for value opportunities to buy and move into or to acquire as an investment now is a great time to be patient but ready to strike when the right opportunity comes up. Obviously, interest rates are higher right now but if you have an ability to put more cash down or can cash flow higher interest until the rates start to come back down, we’re seeing some great opportunities now and expect to see even more great opportunities over the coming months as competition among active listings continues to increase.

It’s important to always remember that real estate is a long term investment and over the long term, we are bullish that prices will continue to increase steadily given current supply/demand constraints.

Need help finding the right opportunities or want to stay on the pulse of the market with resale listings and new developments that we feel represent strong buying opportunities?

DM us on social, reach out to us via our website or call us anytime to get started.

-CC